What is Waqf

A charitable endowment in Islamic law

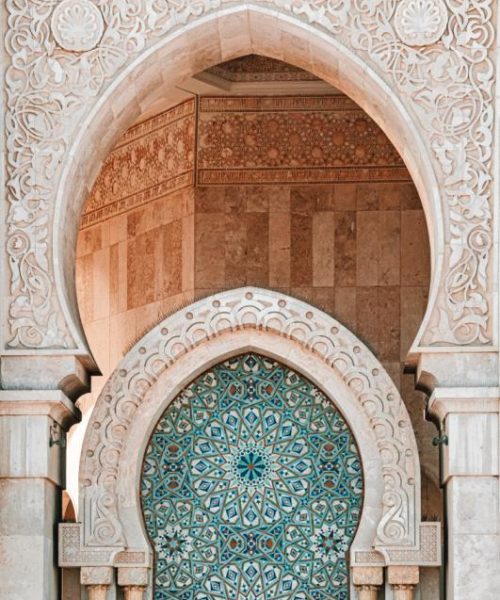

Reviving the Legacy of Waqf : A Forgotten Sunnah for Sustainable Charity

In the golden age of Islam, there emerged an institution so powerful and transformative that it became the backbone of society’s prosperity. It wasn’t a tax, nor a short-term solution – it was a Waqf.

What is Waqf?

A waqf (plural: awqāf) is a charitable endowment in Islamic law. It refers to an asset – often land, property, money, or another income-generating resource – that is permanently dedicated for the benefit of the community. Once something is made into a waqf, it no longer belongs to any individual. Instead, its profits and benefits are used for noble causes: supporting the poor, funding education, maintaining mosques, and much more.

Unlike one-off donations, which are spent and finished, a waqf continues to give. It becomes sadaqah jariyah – ongoing charity – rewarding the donor even after their death. It’s an economic engine fuelled by the intention to please Allah.

The Origins: Umar ibn al-Khattab and the Land of Khaybar

The concept of waqf was formalised during the time of the Prophet Muhammad (peace be upon him).

One of the earliest and most notable examples comes from Umar ibn al-Khattab (may Allah be pleased with him), who acquired a valuable piece of land in Khaybar and asked the Prophet what to do with it.

The Prophet (peace be upon him) said: “If you like, you may give the land as endowment and give its fruits in charity.” (Sahih al-Bukhari)

Umar declared the land a waqf. It could no longer be sold, inherited, or gifted – only its yield could be used to help the needy, free slaves, assist travellers, and support those in hardship.

This was the first official waqf in Islam. From there, the idea spread rapidly. Across the Muslim world – from Damascus to Cairo, Istanbul to Baghdad – waqf foundations built hospitals, schools, orphanages, mosques, and roads. These weren’t state-funded projects, but community-led legacies built by visionary Muslims.

A Divine Economic Solution

Islam doesn’t just encourage charity – it institutionalises it. Waqf isn’t just a good deed; it’s a sunnah-based system that enables the ummah to take charge of its financial future.

While many conventional charities struggle to survive on unpredictable donations, waqf offers stability and recurring income. It transforms the ummah from one in need, to one that meets its own needs.

Today, many Islamic charities and institutions are struggling. The solution doesn’t lie in more fundraising events or emergency campaigns – it lies in reviving waqf. The prophetic model still holds the answer.

Returning to the Sunnah of Self-Sustainability

Our institutions must move beyond acting solely as recipients. They need to become stewards of lasting impact. By establishing endowments – through property, investments, or business income – they can secure sustainable income streams and reduce dependence on short-term donations.

Imagine a madrasa supported by rental income from a waqf property. Imagine a charity building affordable housing and using the profits to fund food banks and scholarships. This isn’t wishful thinking – it’s exactly how our predecessors sustained their communities for centuries.

The Call to Action

Today, the ummah urgently needs economic self-sufficiency. We don’t need to wait for external solutions – we already have the blueprint in our tradition.

It’s time to reawaken the spirit of waqf: to build institutions that endure, to invest in legacies that outlive us, and to follow the prophetic model that fused spirituality with sustainability.

Let our generation be the one that says: we revived the forgotten sunnah. We rebuilt the waqf. We strengthened our communities.

What We’re Doing at Waqf Wakalah

At Waqf Wakalah, we’re pioneering a new approach. We bring together Muslim charities, mosques, and educational institutions onto one powerful platform – unlocking collective strength, greater buying power, and shared purpose.

By partnering with us, institutions gain more than support – they gain sustainability. We don’t just raise funds for them; we also promote the inclusion of waqf in both Muslim and non-Muslim legacy plans, through wills and estate planning.

This unified effort is on track to generate hundreds of millions of pounds, paving the way for long-term financial independence across the sector.